Hiding in plain sight - the risks of sticking with 'business as usual'

Our research shows that organisations in every sector face a variety of risks associated with ‘business as usual’ (the ‘linear’ economy). Here, we introduce our new guide to ‘linear risks’.

2 minute read

Every year, I’m fascinated to read the World Economic Forum’s Global Risk Report and find out what global business leaders, economists, scientists and policymakers see as the critical threats to our society and economy. The 2021 report highlights the top 3 risks by likelihood as extreme weather, climate action failure, and human environmental damage.

From a business perspective, we need to be aware of these ‘big picture’ threats, together with other, perhaps more obscure risks. Not recognising and planning for potential threats means we leave ourselves open to disruption, under-performance, and possible failure. As the saying goes, failing to plan is planning to fail.

‘As-is’ is a recipe for a shipwreck

Leadership expert Steve Denning, writing in Forbes (Ten Reasons Why Risk Management Increases Risk), believes too many people associate risk management with new business opportunities, such as innovation and acquisition. They work on the assumption that the existing business is risk-free, able to continue indefinitely ‘as-is’. But Denning warns us that “as-is is a recipe for a shipwreck”, because, (as we are finding), most firms live in a VUCA world – volatile, uncertain, complex and ambiguous.

We know people struggle to find time to think about external issues, and let’s face it, lots of the news on geopolitics, climate, plastics and damage to nature can be depressing. So it is easy to feel disconnected from big-picture trends and issues, and hope they won’t affect your business. But that’s a risky approach!

Instead, thinking about risks, and deciding if, and how badly they might affect your business, can help you decide what to change, or what to keep an eye on. In an earlier job, I looked after risk management for major projects. I’m cautious by nature, so I relished looking at the future, from inside and outside the organisation, and working out what might disrupt our plans.

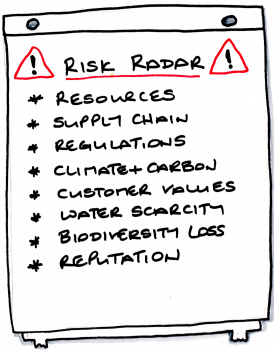

Our research shows that organisations in every sector face a variety of risks associated with ‘business as usual’ (the ‘linear’ economy), and the Circular Economy Podcast show-notes on ‘linear risks’ (Episode 2) is one of our most-visited webpages.

Our free Linear Risks Guide and Matrix

We recently created a 23-page Linear Risks Guide for clients who book our Kickstart and Kickstart+ coaching programmes. We thought it would be useful to share these, so you can use them to review the risks facing your business, and think about ways to avoid them.

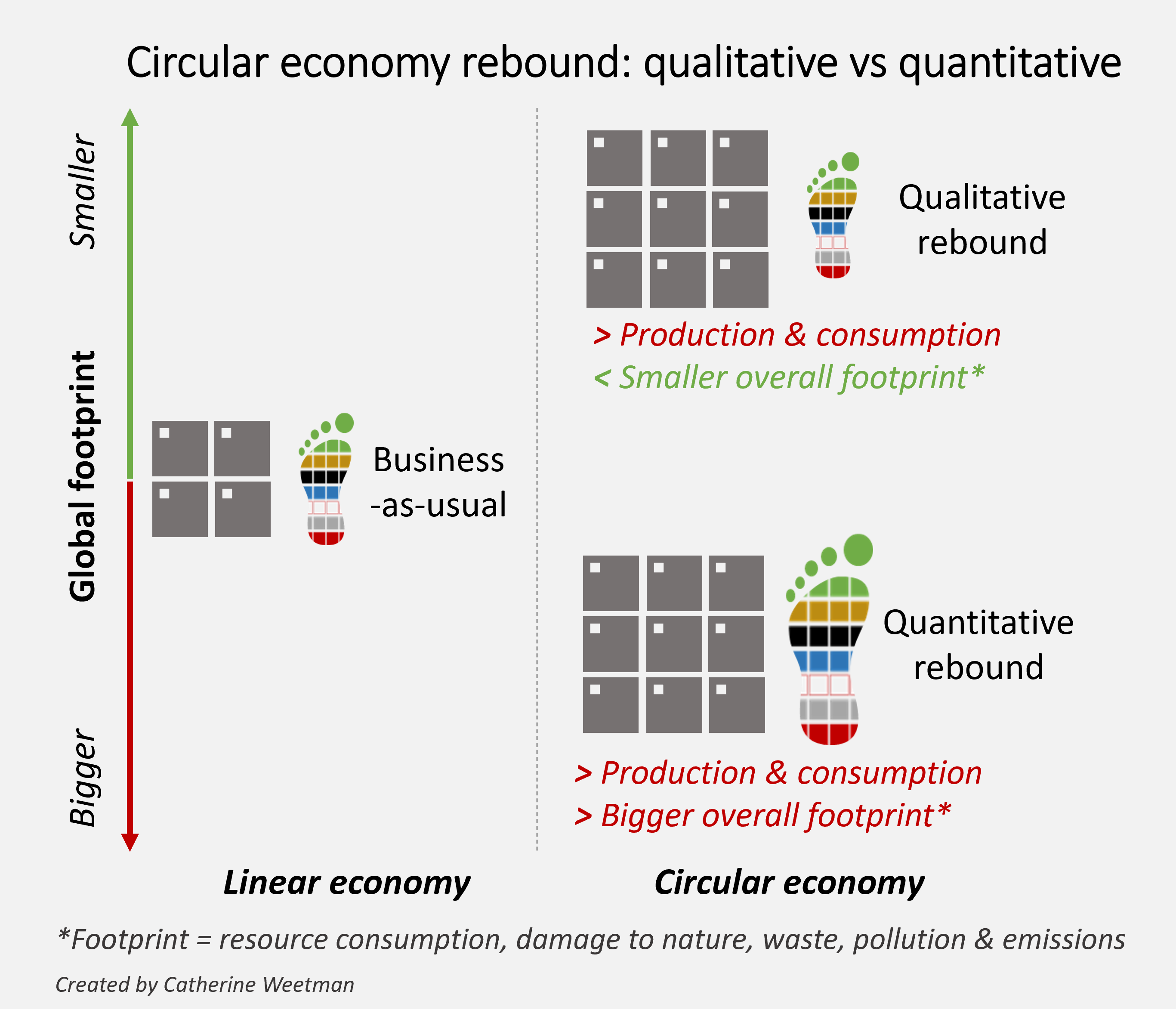

We’ve focused on the risks related to our modern, ‘linear economy’, in which we take materials, make a product, use it and then discard it. We look at risks related to the markets you operate in, your business model and competitor pressures, your production and supply chain operations, and regulatory and legal factors.

We’ve mapped those risks along the value chain, using PESTLE analysis (political, economic, social and technological, legal and environmental) as a structure.

To give you a snapshot view, we’ve also created a summary matrix, with over 40 different categories of risk and an example of each.

Visit the Linear Risks Guide page on our website to download the free 7-page Linear Risk Matrix mini-guide, or get the full 23-page Linear Risks Guide (also free).

Featured image: Hartleys Crocodile Adventures, Cairns, Australia – by David Clode on Unsplash

Catherine Weetman advises businesses, gives workshops & talks, and writes about the circular economy. Her award-winning Circular Economy Handbook explains the concept and practicalities, in plain English. It includes lots of real examples and tips on getting started.

To find out more about the circular economy, why not listen to Episode 1 of the Circular Economy Podcast, read our guide: What is the Circular Economy, or stay in touch to get the latest episode and insights, straight to your inbox…