Being explicit about what we don’t know can help us better understand how climate and ecological risk might play out.

3 minute read

Inflation is back in the news these days, mainly due to ‘black swan’ events including wars and supply chain disruptions, together with the ever-mounting pressure on resources. As we know, prices reflect the relationship between supply and demand, and it should be obvious that climate and ecosystem destruction is already affecting the security of supplies for lots of products and materials.

Our warmer and wetter climate, together with climate-related disasters including wildfires, floods and droughts, is already undermining food security and the availability of many agricultural products.

What's on your risk radar?

How many organisations are thinking deeply about the impact of extreme weather? What are governments and businesses doing to understand this, to mitigate against it, to create a more resilient and regenerative system for food and other biological products? It’s all too easy to think that there are alternatives – another country, another region – but every other buyer will be depending on those alternative, too…

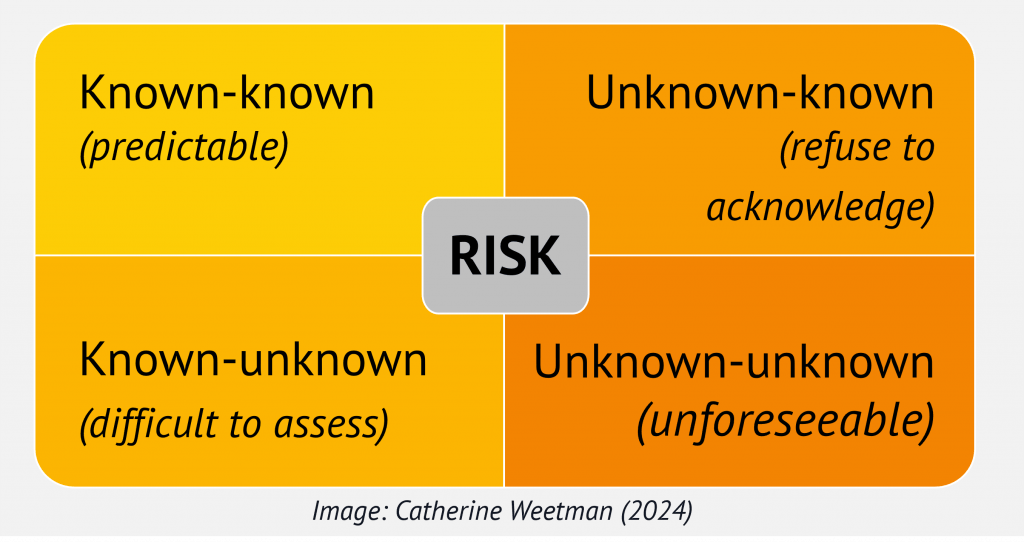

Back in 2010, I gave a talk about inflation and risk. I structured it around the four categories of ‘knowns’ and ‘unknowns’ used (in)famously in 2002, by US Secretary of Defence Donald Rumsfeld. Rumsfeld’s explanation was widely ridiculed, but it turned out he was describing a technique used by NASA, by strategic planners, and in risk management. (A similar approach is used in psychology, where it’s known as the Johari Window.)

Four categories of risk

Here’s a summary of the four categories, and what they mean in the context of inflation and our food supplies:

Known knowns – things that are known to us, and to others. In this context, that warmer weather will improve conditions for certain agricultural pests.

Known unknowns – things which can be reasonably anticipated, but we don’t have enough past experience to quantify them. For example, that warmer weather will reduce agricultural productivity for certain crops.

Unknown knowns – the blind spots, that you pretend not to know.[i] Here, we could think about the mostly unacknowledged risk that climate change and ecosystem destruction is already undermining food security in most countries, and things are set to get much worse.

Unknown unknowns (unexpected or unforeseeable conditions/phenomena), which pose a potentially greater risk simply because they cannot be anticipated, based on past experience or investigation. For food inflation, we could think about the ‘domino’ effect, when there is a shortage of one staple crop from one source (e.g wheat from Canada) and the increased demand for the same or similar crops puts pressure on every global source. And just to amp that up a bit, we can easily imagine commodity traders piling in for their unearned profits.

Why is this relevant to inflation?

It seems clear that we have our heads in the sand, thinking that the future is a continuation of the past, and ignoring the basic rules of risk management.

My LinkedIn contact Anton Theunynck kindly sent me a paper by Maximilian Kotz from the PIK – Potsdam Institute for Climate Impact Research and his research colleagues from the European Central Bank, which highlights the lack of research looking at how climate change will drive future inflation risks, both for food and other drivers of headline inflation.

Are businesses and governments starting to wake up to this, and take it seriously? Are they seeing the opportunities of regenerative agriculture, of reducing food waste, of supporting more resilient supply chains? Are you seeing signals of change?

Read more in Nature: Global warming and heat extremes to enhance inflationary pressures, by Maximilian Kotz, Friderike Kuik, Eliza Lis & Christiane Nickel. Published: 21 March 2024. Available from: https://www.nature.com/articles/s43247-023-01173-x (Open Access)

Thanks to Anton Theunyck for sharing this.

Notes & references

[i] Unknown unknowns – according to psychoanalytic philosopher Slavoj Žižek – something you intentionally refuse to acknowledge that you know. Source: Wikipedia https://en.wikipedia.org/wiki/There_are_unknown_unknowns

International speaker, author and strategic advisor, Catherine Weetman helps people discover why circular, regenerative and fair solutions are better for people, planet – and prosperity.

Catherine’s award-winning A Circular Economy Handbook, published by Kogan Page, is now in its 2nd edition. Catherine also hosts the popular Circular Economy Podcast, with listeners in over 150 countries.

Catherine’s wide-ranging experience, systems-thinking perspective, and willingness to challenge business-as-usual, together with a deep understanding of circular and regenerative practices across industry sectors, means she’s uniquely qualified to help you succeed with circular. Read more about Catherine here.

To find out more about the circular economy, why not listen to Episode 1 of the Circular Economy Podcast, read our guide: What is the Circular Economy, or stay in touch to get the latest episode and insights, straight to your inbox…