Companies and governments are making transformational net-zero climate-change commitments – what’s creating the momentum and how can going circular help?

4 minute read

2020 saw transformational net-zero climate change commitments from businesses, governments and investors. [Net zero means emitting no more greenhouse gases that you remove from the atmosphere.] Many of those commitments are for net-zero before the scientifically-established deadline of 2050, as called for in the Paris Agreement.

The UK was the first country to pass its net-zero commitment into law, back in June 2019, and in 2020 we saw commitments from China, the European Union and other countries.

Joe Biden, the new President of the US, was elected on a pledge to aim for net-zero emissions by 2050 and rejoined the Paris Agreement on his first day in office.

BlackRock sees opportunities of net-zero goal

BlackRock, one of the biggest investment firms, is led by CEO Larry Fink. Each year, Larry writes a letter to his investors and a separate open letter to CEOs. He aims to ‘highlight issues that are pivotal to creating durable value’, including management of capital, long-term strategy, purpose and climate change. In 2015 he urged business leaders to resist the pressure for short-term value extraction over value creation for longer-term owners, and in 2018 he set out his belief that every company should serve a social purpose, showing how they contribute to society as well as delivering financial performance.

By 2020, BlackRock announced it was making sustainability its new standard for investing, to help its clients build resilient portfolios and achieve better long-term returns. It’s created a new standard for climate data and introduced nearly 100 new sustainability funds.

BlackRock itself is committed to a net-zero goal, and is helping its investors ‘capture opportunities created by the transition’.

CEO Larry Fink believes the world is ‘on the cusp of a Teutonic shift – a fundamental reallocation towards sustainable assets’ with investments in sustainable products during 2020 almost doubling over the previous year.

Fink says ‘No issue ranks higher than climate change on our clients’ lists of priorities. They ask us about it nearly every day.’

Building a net-zero strategy

So what can we do to help the transformation, and make sure our business strategies are primed to capture the opportunities?

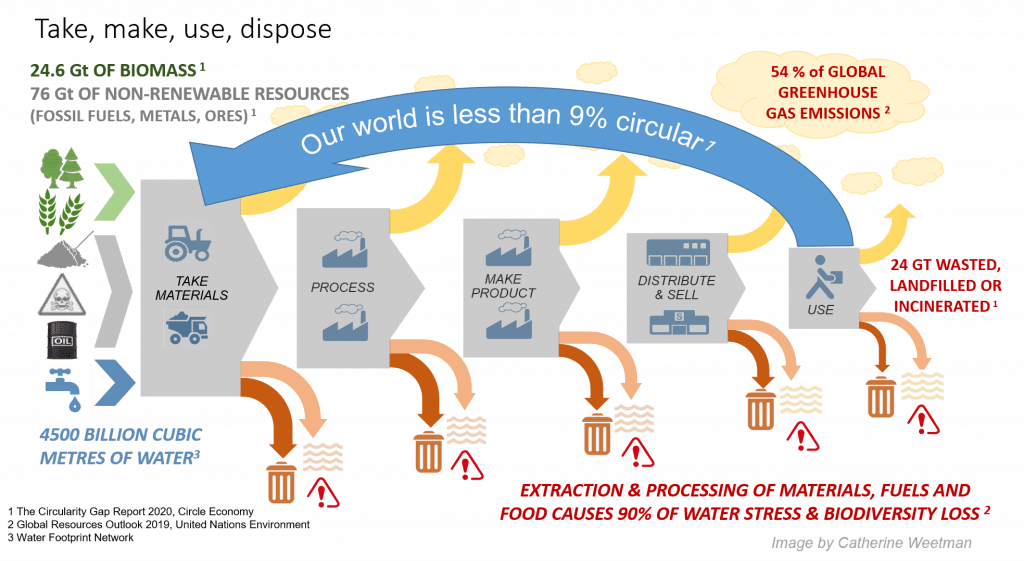

Using renewable energy is an integral part of the circular economy, but going circular can make a big contribution to net-zero targets. reveals the need for a fundamental shift in the global approach to cutting emissions.

A paper released by the Ellen MacArthur Foundation in collaboration with Material Economics in 2019, Completing the Picture: How the Circular Economy Tackles Climate Change points out that while moving to renewables can address 55% of global GHG emissions, to achieve net-zero, we must also tackle the remaining 45%.

Concentrating on five key areas (cement, plastics, steel, aluminium, and food) the paper illustrates how designing out waste, keeping materials in use, and regenerating farmland can reduce these emissions by 9.3 billion tonnes, noting that is equivalent to eliminating current emissions from all forms of transport globally.

In my presentations, I often use a statistic from the UN Environment Programme (UNEP) Global Resources Outlook 2019 report (see the Infographic on the report Resources page). UNEP says ‘the extraction and processing* of materials, fuels and food make up about half of total global greenhouse gas emissions (not including climate impacts related to land use) and more than 90 % of biodiversity loss and water stress’.

Once we start to think about how circular systems are different, and to consider using recycled materials instead of extracting virgin resources, we can see how to avoid the high levels of pollution and destruction from the mining industries.

Regenerating natural resources supports climate and healthy planet goals too. Regenerative agriculture offers fantastic opportunities to lock-up carbon, improve biodiversity, produce healthy food and livestock with a wider range of micronutrients – which in turn is better for our physical and mental health. What’s more, it aims to eliminate the need for artificial inputs like fertilizers and pesticides and avoids the use of imported feed that is often responsible for deforestation.

What’s more, the ethics are better. Why do we think it’s right to feed livestock on a monotonous diet, including food they haven’t evolved to digest, and preventing them from self-medicating on indigenous herbs and other plants? If you’re keen to learn more, here’s a list of regenerative agriculture organisations from Foodtank.

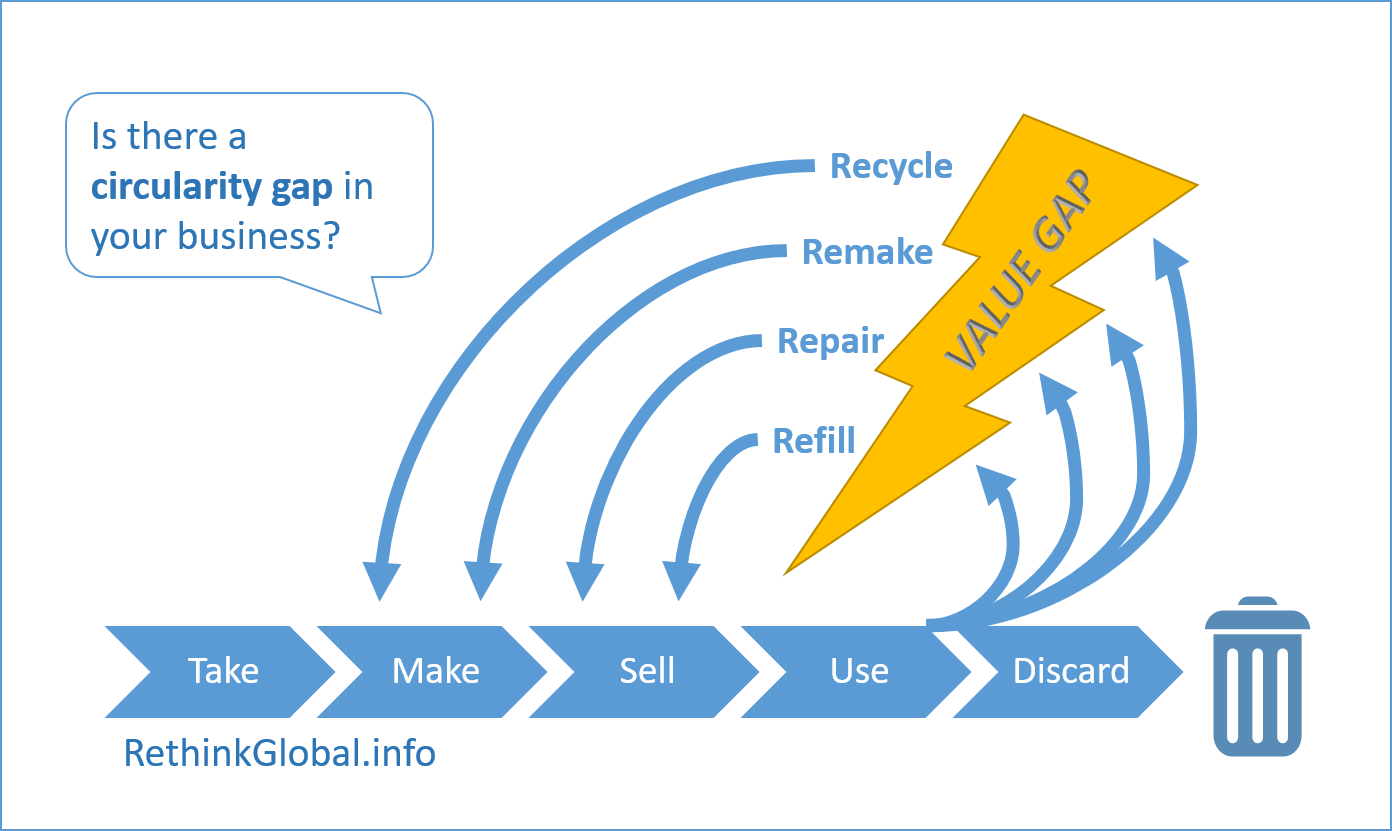

Slowing the flow

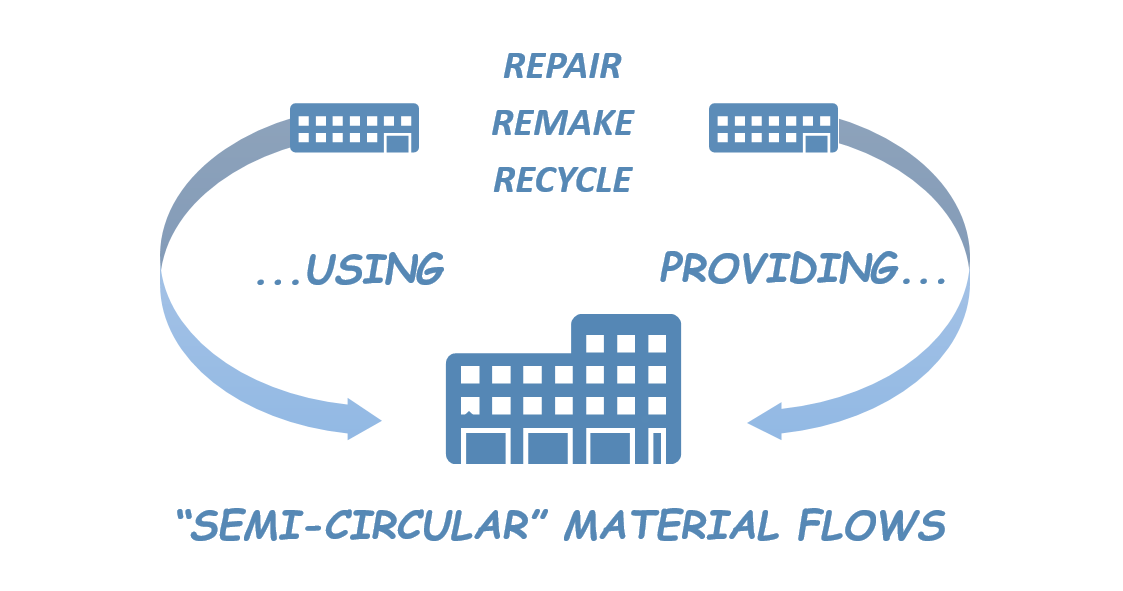

Circular approaches can reduce production and minimise waste in other ways. Keeping products in use for longer, and/or getting more productive use out of them (for example through resale, sharing or pay-per-use) slows down the manufacturing flows. Aiming for zero waste, ensuring that any unused or excess products and materials become ‘food’ for another process, also reduces the level of extraction and material production.

A triple zero!

So we need to aim for zero waste AND net-zero emissions – and zero harm. Whilst that might seem like a massive challenge, a mindset of ‘Zero’ can be transformational. It encourages you to think differently, aim for a ‘moonshot’ instead of ‘marginal gains’ and focusing on the problem from the perspective of people and planet.

Ray Anderson, one of our heroes (who sadly passed away in 2011), set out Mission Zero for his company, Interface, back in 1994. Read about how Interface achieved carbon neutrality, the ripple effect they’ve had on the business community, and their new mission, Climate Take Back, here

Catherine Weetman advises businesses, gives workshops & talks, and writes about the circular economy. Her award-winning Circular Economy Handbook explains the concept and practicalities, in plain English. It includes lots of real examples and tips on getting started.

To find out more about the circular economy, why not listen to Episode 1 of the Circular Economy Podcast, read our guide: What is the Circular Economy, or find out more about Catherine’s award-winning book: A Circular Economy Handbook for Business and Supply Chains.

Why not stay in touch and get the latest episode and insights, straight to your inbox…